Today’s post marks the first edition of our new content concept.

I received so much feedback from you and really took the time to analyze and derive necessary actions. Here are the core results:

- I will try to make the posts more personal, adding stories and experiences I made when trading cryptos — so you don’t have to make the same mistakes I did.

- The content will mainly focus on crypto trading tips, innovations, crypto data, and news from the app — all to help you to improve your trading success.

I hope you like this new concept as much as I do.

Ready? Let’s get into it!

A crypto trading bot is often considered the holy grail. Like a unique black box that miraculously creates profits. Well, sorry to smash your dreams right at the beginning, but this is not the case.

However, when used correctly, a crypto trading bot can do two things: First, it can reduce trading efforts massively — especially when it comes to rather annoying tasks, such as monitoring the charts for trading signals.

Moreover, a trading bot can increase your trading results significantly since it eliminates gut feelings and follows a clear structure.

In this post, I will guide you step-by-step through the process of setting up a crypto trading bot.

However, we will focus on the trading part with this post and won’t talk too much about the technical part. Why? Because it’s the critical part. The technical setup is relatively simple when you use the right tools. But I will have a word on it later.

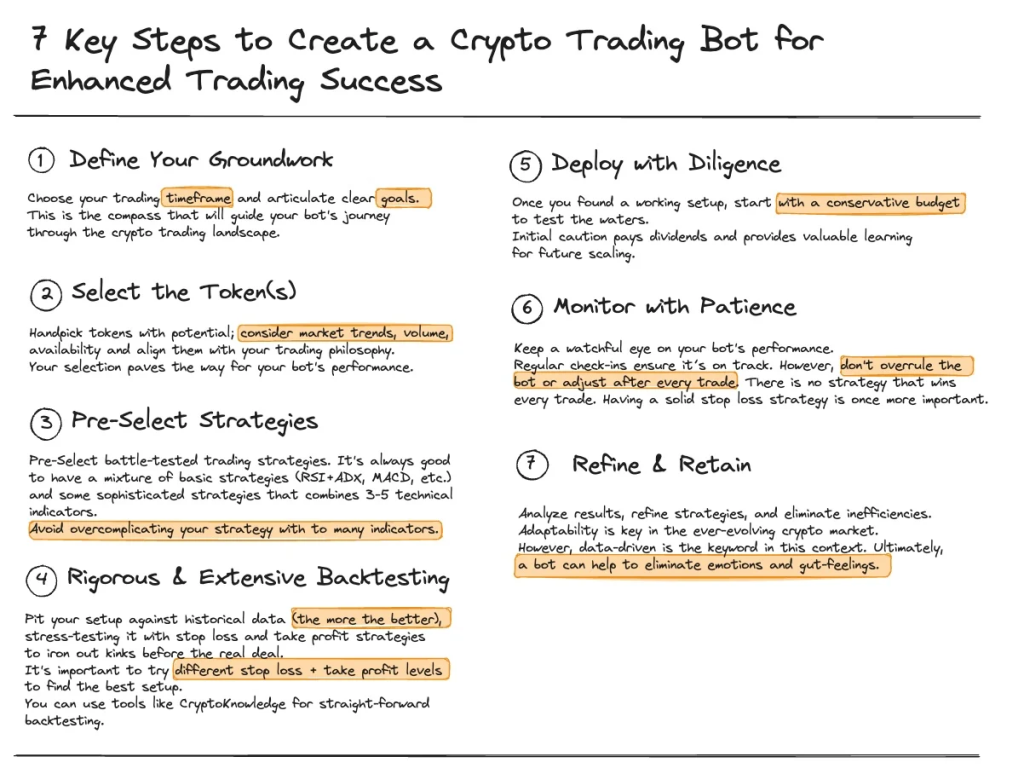

Step 1: Define Your Groundwork

The first step in your trading bot journey begins with setting clear intentions.

Choose your trading timeframe — be it short scalping sessions or extended position trades — and articulate your goals.

What are you looking to achieve with your bot? Defining this from the outset will serve as your compass, steering you through the volatile landscape of crypto trading.

Step 2: Select the Token(s)

Token selection is not to be underestimated. Don’t try to trade every token. Instead, handpick tokens that show promise and resonate with your trading philosophy.

Consider market trends, volume, and liquidity when making your choices. The proper tokens can significantly impact your bot’s performance, paving the way for more successful trades.

Step 3: Pre-Select Strategies

Strategy is the heart of your trading bot. Opt for battle-tested strategies such as RSI+ADX, MACD, or a more sophisticated combination of 3–5 technical indicators that align with your trading style.

Remember, simplicity can often lead to efficiency — avoid overcomplicating your bot with too many indicators.

If you don’t know where to start with technical indicators, you should check out my 6-Day eMail Trading Course, where I introduce several indicators and sophisticated trading strategies.

Step 4: Rigorous & Extensive Backtesting

Before your bot ever makes a live trade, it should undergo thorough backtesting with historical market data.

The more data you can test, including different market conditions, the better.

This step is absolutely crucial for fine-tuning stop loss and take profit levels and ensuring your bot can handle the market’s unpredictability.

Check out the CryptoKnowledge app to get started with backtesting for free.

Step 5: Deploy with Diligence

Now that you’ve laid the groundwork, it’s time to bring your bot to life.

But don’t get overwhelmed! Start with a conservative budget to mitigate risk as you test the waters. This initial caution safeguards your investment and provides valuable insights for future scaling.

Step 6: Monitor with Patience

Patience is a virtue, especially when it comes to monitoring your bot’s performance. Regular check-ins are essential to ensure it’s on track, but resist the urge to make knee-jerk reactions to every market move.

Remember why you wanted to set up a bot: First and foremost, to eliminate emotions from trades. Therefore, it is highly important to let the bot do the work and not interfere with every trade.

Embrace a holistic view and maintain a solid stop-loss strategy to safeguard against inevitable market fluctuations.

Step 7: Refine & Retain

The final step is an ongoing process: analyzing the results, refining the strategy, and eliminating any inefficiencies.

The crypto market is not static, so adaptability is key. Your bot should evolve with the market, always data-driven, to mitigate the emotional aspect of trading decisions.

Conclusion: Your Next Steps Towards Trading Success

Building a successful crypto trading bot doesn’t have to be an enigma. By following these seven key steps, you can create a bot that trades effectively and aligns with your personal trading objectives.

Remember, a trading bot is a tool — not a set-it-and-forget-it solution. Stay engaged, stay informed, and continuously seek to improve your strategies.

Write engaging and informative content that will help your readers understand your message

What’s Next?

Whenever you are ready, there are 3 ways I can help you:

#1 Ready to trade like a pro? Check out our Strategy OS program giving you access to some of the most successful and robust trading strategies >>> Discover More Here

#2 Need to get a better structure for your trade? Discover our Crypto Trading Toolkit containing trading journals, asset manager, and risk assessment templates. >>> It’s available for free here

#3 Never want to miss a trading signal and ready to automate your trading? Download our app and get trading signals for more than 200 crypto tokens. >>> Available on iOS and Android