Before I started trading cryptos, I didn’t even know I could feel such strong emotions. I read some articles about the emotional stress of being a crypto trader. However, I couldn’t imagine with what I was confronted. The profits, the loss, green candles, red candles, tons of news pouring down on you, not to mention fear and greed.

Crypto trading transformed me. Personally and emotionally. I had to go down and discover my darkest emotions before I learned how to control and manage them.

The most significant part of this learning process was linked to a devastating loss of more than 150k during the last bull run (Here’s the complete article about that).

However, in discussions on social media, the “emotional stress” part of crypto trading is not very present. Everybody shares their successes and successful trades — but no one shares the emotional stress they faced.

That’s why I thought it is a good idea to share some aspects about emotional stress you most definitely face when starting your crypto trading adventure. Plus, I want to share some things I have learned have helped me become a better trader.

Let’s dive in!

The Emotional (Stress) Rollercoaster Of Being A Crypto Trader

When trading cryptos, there are usually four emotions that are most dangerous: fear and greed, euphoria and despair.

And to add one thing: I am a very rational person. I never thought that things like greed and euphoria could catch. I rely on numbers, facts, and figures. But believe me, it’s like a drug. Once these emotions have taken over, it is super tough to get out.

Here are some more details:

Fear and Greed:

These two emotions are the main culprits behind many trading missteps. Greed drives traders to chase after profits, often ignoring the signs of an overheated market or holding onto assets for too long in the hope of even higher returns.

Fear, on the other hand, can lead to panic selling during market dips, resulting in the realization of losses that could have been avoided with a more measured approach.

Euphoria and Despair

The quick gains characteristic of bull markets can lead to euphoria, where traders overestimate their ability to pick winners, ignoring the risks.

Conversely, prolonged bear markets can plunge traders into despair, making it hard to stay the course and maintain a long-term perspective.

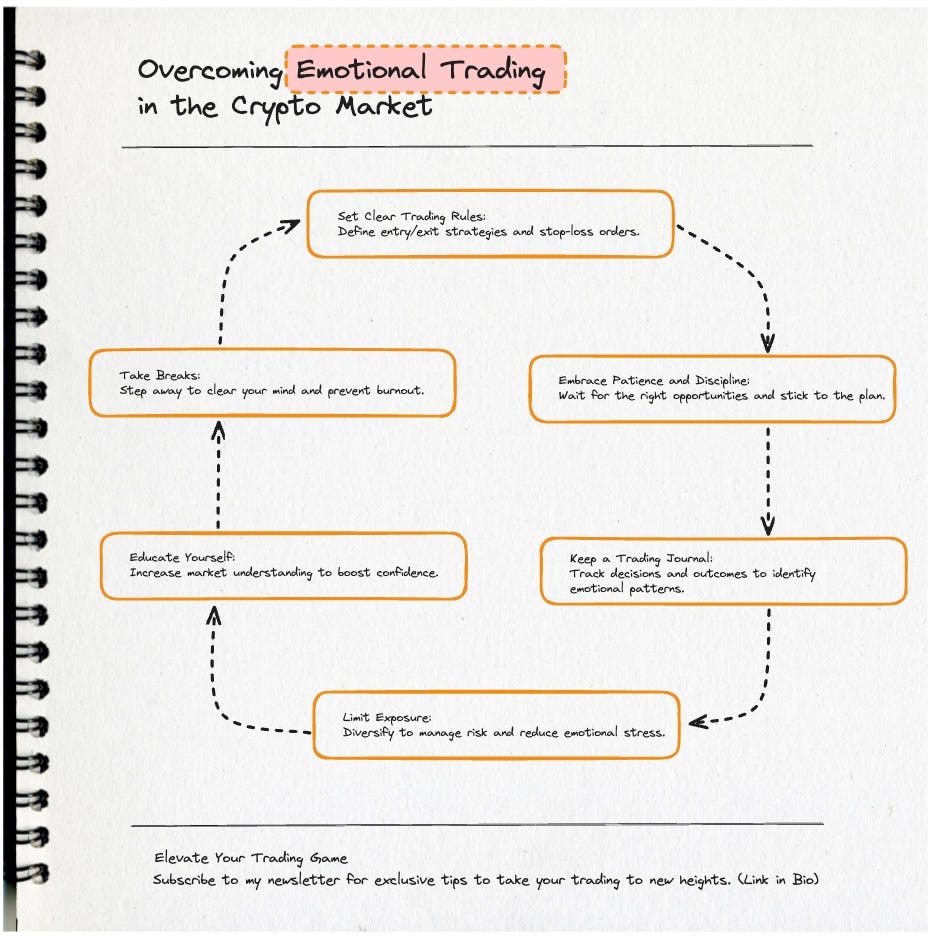

Strategies for Emotional Control

As mentioned, I have experienced all of the above. Here’s the important part: You can learn to handle these emotions. It’s nothing you can do overnight but something you must start and evolve. Here are the key actions I took:

Set Clear Trading Rules: One of the most effective ways to mitigate emotional stress when trading trading is to establish and adhere to a set of clear, objective trading rules. These rules should cover entry and exit strategies, stop-loss orders, and the maximum percentage of your portfolio to risk on a single trade.

Embrace Patience and Discipline: Patience allows traders to wait for the right trading opportunities rather than making hasty decisions based on short-term market movements. Discipline ensures adherence to a trading plan, even when emotions pull you in a different direction.

Keep a Trading Journal: Documenting your trades, including the rationale behind each decision and its outcome, can provide valuable insights into the influence of emotions on your trading. Over time, this record can help identify patterns of emotional trading and areas for improvement. By the way: We just launched our brand-new, free trading journal app. You may check it out here.

Limit Exposure: Don’t put all your eggs in one basket. Diversifying your portfolio can help manage risk and reduce the emotional impact of poor performance in any single investment.

Educate Yourself: The more you understand the market and your chosen investments, the more confident you’ll feel in your trading decisions. This confidence can help temper emotional responses to market fluctuations.

Take Breaks: Sometimes, the best way to manage emotional stress is to take a step back. Regular breaks from trading can clear your mind and reduce the risk of burnout.

Emotional Stress When Trading Cryptos — A Conclusion

The path to becoming a successful crypto trader is as much about mastering your emotions as it is about learning the market. By recognizing the emotional traps inherent in trading and implementing strategies to manage them, you can improve your trading performance and overall well-being. Remember, emotional control is your anchor in the unpredictable seas of cryptocurrency trading.

What’s Next?

Whenever you are ready, there are three ways I can help you:

#1 Ready to trade like a pro? Check out our Strategy OS program, giving you access to some of the most successful and robust trading strategies >>> Discover More Here.

#2 Need to get a better structure for your trade? Discover our Trading OS, which contains trading journals, asset managers, and risk assessment templates. >>> It’s available for free here

#3 Never want to miss a trading signal and ready to automate your trading? Download our app and get trading signals for more than 200 crypto tokens. >>> Available on iOS and Android and web-based.